Company Registration in Pakistan: A Complete Expert Guide to Seamless Business Confirmation

Request a Free Quote

Preface: The Strategic Imperative of Formal Business Registration

In the current competitive global landscape, company registration in Pakistan is the first pivotal step that turns a business idea into a well-established and well-protected reality. It is more than just paperwork; it is a strategic move that offers limited liability protection, separates personal assets from business pitfalls, and opens doors to funding, connections, and growth opportunities. The process is governed by the Companies Act, 2017, which provides the legal framework and compliance requirements for anyone looking to register a company in Pakistan. The Securities and Exchange Commission of Pakistan (SECP) serves as the primary authority overseeing company formation in Pakistan.

In recent times, the SECP has taken major steps to ameliorate the Ease of Doing Business, introducing a fully digital business registration process in Pakistan through its eZfile eServices portal. This stoner-friendly system allows entrepreneurs to start a company in Pakistan in many structured ways, reflecting the government’s focus on speed and effectiveness. While these reforms make it easier to start a company, they also demand perfection.

Crimes in attestation or misreading the company enrollment in Pakistan, conditions, and procedures can still lead to detainments. Knowing the right approach is essential for the successful enrollment of a private limited company in Pakistan or any other business type. This companion serves as an expert roadmap to flawless online company enrollment in Pakistan, helping entrepreneurs navigate each phase from planning and document preparation to objectification and post-registration compliance. Whether you aim to form a private limited company in Pakistan, explore types of companies in Pakistan, or understand how to manage your new registrant company, this resource provides a step-by-step view.

For businesses possessed or managed by expats, professional Account Services for Overseas Pakistanis can simplify compliance, helping ensure a smooth fiscal and legal launch.

Nonfoundational Planning: Choosing the Right Commercial Structure

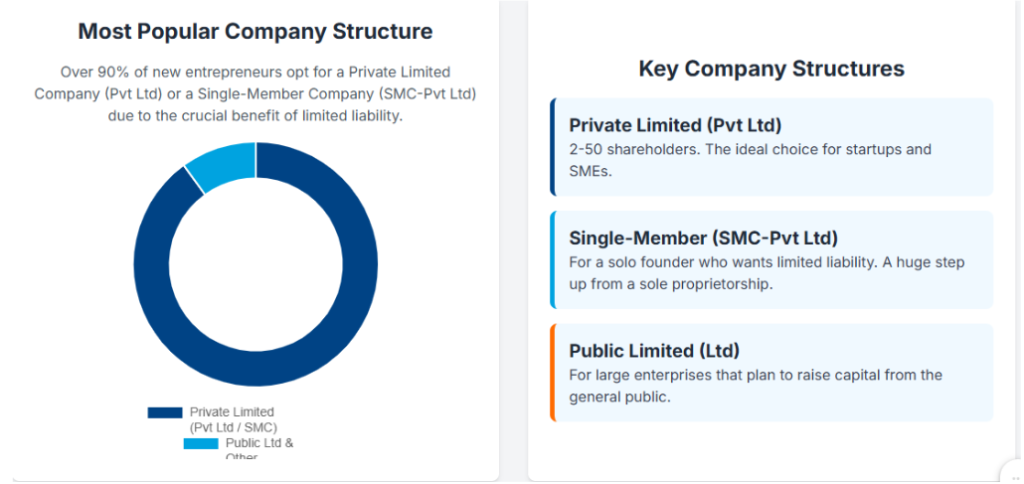

Before starting the process to create a company, it is essential to determine which legal structure best fits your pretensions, power preferences, and future growth plans. The chosen structure influences compliance scores, liability exposure, and functional inflexibility. The Companies Act, 2017, outlines several types of companies in Pakistan, each serving different business requirements.

Private Limited Company (Pvt. Ltd.)

The private limited company in Pakistan is the most common and favored structure for startups and small to medium-sized enterprises. It offers inflexibility, limited liability, and credibility.

Conditions for pvt limited company registration in Pakistan

To begin private limited company registration, at least two subscribers and two directors are needed. Power is confined, meaning shares cannot be offered to the public, and the class is limited to fifty individuals. The main advantage is limited liability, which means that shareholders’ personal assets are protected, and liability extends only to the value of their shares. This makes private limited company registration in Pakistan a secure and practical choice for growing businesses.

Single Member Company (SMC Pvt. Ltd.)

For individual entrepreneurs, a Single Member Company (SMC) is an ideal model. It provides full power and limited liability protection, combining independence with legal credibility. It operates just like a private limited company registration, but with a single proprietor who has complete control over decision-making and gains. The SMC model is particularly useful for solo professionals and freelancers who want to formalize their operations without participating in equity or operational liabilities.

Pub Public Limited Company (Ltd.)

A public limited company in Pakistan suits large-scale enterprises aiming to raise finances from the public. Unlike private realities, it can issue shares intimately and requires at least three original subscribers. Although it offers less capital access, this structure comes with advanced non-supervisory scores than an LTD company for registration for a smaller business.

Choosing between a private limited company in Pakistan and an SMC depends on power pretensions and operational style. An SMC gives complete control, while a Pvt Ltd structure involves multiple directors, participatory investment, and formal governance procedures like board meetings and director forms. Each structure offers unique advantages and understanding them is crucial before proceeding with company registration in Pakistan. Whether you plan to register a company in Pakistan as an SMC, Pvt Ltd, or Ltd, aligning your choice with a long-term strategy ensures sustainable growth. For entrepreneurs in creative diligence like Event Management, opting for the right company type from the launch can make future expansion and compliance smoother.

Table 1: Comparison of Key Company Types and Requirements in Pakistan

| Feature | Private Limited Company (Pvt. Ltd.) | Single Member Company (SMC Pvt. Ltd.) | Public Limited Company (Ltd.) |

|---|---|---|---|

| Minimum Members/Shareholders | 2 (Maximum 50) | 1 | 3 (Unlimited shareholders) |

| Minimum Directors | 2 | 1 | 3 |

| Liability | Limited to unpaid share value | Limited | Limited |

| Share Transfer | Restricted by Articles of Association (AoA) | Not applicable | Freely transferable (if listed) |

| Suitable For | SMEs, Startups, Shared Private Investment | Sole Proprietorship with Limited Liability | Large-scale Operations, Public Funding |

Phase A SECP Pre-Incorporation Formalities

The smooth and timely completion of the register process in Pakistan depends on how well the original digital and legal setup is handled. Every successful company registration in Pakistan begins with these pivotal pre-incorporation formalities.

Step 1 Digital Preparedness (Stoner Registration and DSC)

The first step is to establish a digital presence with the SECP. Entrepreneurs must register as a new user on the SECP eZfile eServices portal to access all nonsupervisory forms for Pakistan company formation.

Acquisition of Digital hand instruments (DSC)

A vital requirement for business registration in Pakistan is that each subscriber hold a Digital Signature Certificate (DSC). These instruments, issued by licensed authorities such as NIFT, authenticate all online forms. To apply, subscribers must submit copies of their CNIC or passport, a recent photo, a hand impression, and evidence of address. While SECP’s Fast Track Registration Services can speed things up, acquiring DSCs can still delay the process, especially when multiple subscribers are involved. Since this step relies on third-party verification, digital readiness plays a major part in determining how quickly you can start a company in Pakistan. Specifically, DSCs are not needed for the original business name registration in Pakistan step.

Step 2: Securing Your Brand Name and Business Name Registration in Pakistan

Once the digital registration is complete, the next step is to reserve your company name through the SECP eZfile system. This can be done independently or as one of your objectification operations. Beforehand cessions, generally before 10:00 a.m., are frequently reused on the same day, and a nominal fee applies for the name of reservation.

Avoiding Name Rejection

To help detainments, the proposed name must comply with SECP’s picking rules. Common rejection reasons include:

- Similarity Names too close to being realities or trademarks.

- Lack of distinctness in general names like “Cement Private Limited” that fail to identify a specific business purpose.

- Missing Entity Identifier Omitting identifiers similar to “Private Limited,” “Pvt. Ltd.,” or “Ltd.”

Choosing the right name is more than a formality; it is part of brand positioning and non-supervisory alignment. A thoughtful name reflects your company’s core purpose and vision, icing it passes SECP scrutiny while setting the stage for unborn Statutory Compliance. By handling these early digital and legal stages effectively, entrepreneurs can make a solid foundation for flawless company registration in Pakistan and long-term functional success.

Client Quote:

“We didn’t realise how strict SECP name rules were until our first choice was rejected. Getting the name right early saved us time, fees, and helped us launch with a strong, professional brand identity.”

Phase B Core Company Incorporation via eZfile (The 4-Step Digitised Procedure)

Once the company name is approved, the next stage is completing the core operation for the LTD company registration and paying the needed SECP fees.

Documentation Checklist (Company registration in Pakistan requirements and procedure)

The eZfile system requires uploading the key, which validates documents that form the legal foundation of the new registrant company. The online platform integrates both operational forms and indigenous documents, allowing much of the process to be generated and perfected within the system.

The Memorandum of Association (MoA) outlines the company’s objects, business compass, and abecedarian powers.

Articles of Association (AoA) define governance rules, director liabilities, and shareholder rights.

Identity Documents are clearly scrutinized clones of CNICs or Passports for all promoters and the Chief Executive Officer (CEO).

Registered Office Address: Details of the business’s physical address in Pakistan.

Fee Payment Proof: Copy of the paid SECP challan or a vindicated online sale.

Application Submission and Verification

For private limited company registration, the objectification process is completed in full on the eZfile portal, including the declaration of the Authorized Share Capital. All documents, including the MoA, AoA, and operational forms, must be digitally signed by the proposed subscribers using their DSCs and Legs. These digital autographs fairly confirm the promoters’ concurrence, barring the need for physical affidavits. Numerous business owners combine business name registration in Pakistan and the objectification forms in a single submission to speed up processing and obtain the Certificate of Incorporation more quickly. This digital system ensures a smooth experience for entrepreneurs seeking to register a company in Pakistan.

Fee Structure and Cost Analysis

The total cost of company registration in Pakistan depends on the company’s Authorized Share Capital and form system. SECP encourages online company registration in Pakistan by offering lower freights compared to homemade cessions. For small businesses, online objectification is cost-effective. For illustration, companies with authorized capital up to PKR 100,000 generally pay around PKR 2,200 in total. As capital increases, freight rates rise incrementally from around PKR 5,000 for over to PKR. When determining authorized capital, promoters should act strategically.

While setting the minimum saves plutocrat outspoken, unborn expansion or investment frequently requires adding the capital driving redundant forms, freight, and possible functional detainments. Planning ahead for implicit growth during Pakistan company formation helps avoid these unborn dislocations. A smart approach to authorized capital not only minimizes unborn executive hassle but also supports long-term Tax Planning and compliance stability.

Table 2: Estimated SECP Incorporation Fees (Based on Authorized Capital, Online Filing)

| Authorized Capital (PKR) | Online Filing Fee (Estimated) | Notes |

|---|---|---|

| Up to PKR 100,000 | PKR 2,200 - 2,500 (Base + Name Res.) | Minimum fee for register company in Pakistan. |

| PKR 100,001 to PKR 1,000,000 | Incremental (Approx. PKR 5,000) | Fee increases incrementally per PKR 100,000 above base. |

| Non-Profit (Section 42 Company) | PKR 27,500 (Filing) + PKR 150,000 (License Fee) | Significantly higher initial cost due to licensing requirements. |

Timelines: How Long Does it Take to Register a Company in Pakistan The timeline for Pakistan company formation largely depends on the chosen service and the delicacy of the submitted documents.

Standard Online Processing. With complete and correct attestation, online company registration in Pakistan generally takes 3 to 5 business days for SECP approval.

Fast Track Registration Services (FTRS). For critical cases, SECP’s FTRS option processes operations within 4 hours upon full submission and payment of an enhanced fee.

Once vindicated, SECP issues the digital Certificate of Incorporation and a unique Company Number, officially completing the enrollment phase. Still, the business must complete pivotal post-incorporation conditions to begin operations. While SECP offers bus-generated templates for MoA and AoA, experts recommend customizing the AoA, especially for a private limited company in Pakistan, to easily define share transfer restrictions and governance rules, precluding unborn shareholder conflicts.

Phase C: Cranking Your Business Reality (Post-Incorporation Compliance)

Entering the Certificate of Incorporation marks the morning of the company’s functional phase. For full business registration in Pakistan, integration with the duty, banking, and labor systems is essential.

Tax Authority Integration FBR Registration (NTN & STRN)

Every registered business must gain a National Tax Number (NTN) from the Federal Board of Revenue (FBR). This unique number enables duty form and legal compliance.

NTN Conditions and the Banking Paradox

The star Officer applies for the NTN using documents such as the Certificate of Incorporation, the CNICs of the directors, an authorization letter, and a bank account instrument in the company’s name. Still, this step frequently creates a circle. FBR requires evidence of a bank account, while banks demand the NTN before cranking one. This is generally resolved by carrying a provisional “Account Opening Letter” from the bank for submission to the FBR.

Sales Tax Registration (STRN)

Companies dealing in taxable goods or services must register for Sales duty via the Iris gate using Form 14(1). The process requires detailed information and verification, including prints of the demesne, mileage measures, and applicable manufacturing outfit, if applicable.

After online submission, biometric verification at a NADRA e-Sahulat Centre is obligatory within 30 days. Missing this step results in junking from the Active Taxpayer List (ATL), leading to advanced withholding levies on deals.

Financial Gateways Corporate Bank Account Opening

Opening a commercial bank account is a critical step in finishing company registration in Pakistan. It enables fiscal deals and compliance with FBR conditions.

Banks generally bear:

- SECP pukka True clones of the Certificate of Incorporation, MoA, and AoA.

- FBR NTN Certificate.

- CNICs/Passports of directors and authorized signatories.

- Company letterhead and sanctioned stamp.

While some banks allow online operations, directors must frequently appear in person and point verification may be done before the account is activated.

Labor Compliance: EOBI and Provincial Social Security

Compliance with labor regulations ensures legal operation and hand protection.

- Provincial Social Security (PESSI/SESSI) is needed for businesses employing five or more people. Employers contribute 6% of gross payment toward hand social security.

- EOBI (Employees’ Old-Age Benefits Institution) is Obligatory for old-age pension content once the business hires eligible workers.

These enrollments must be completed within 30 days of reaching the minimum hand count to avoid forfeitures. Completing these stages not only ensures smooth compliance but also positions the business for future Marketing & Branding openings, helping to build credibility and attract investors in Pakistan’s formal frugality.

Table 3: Post-Incorporation Statutory Registration Timeline

| Stage | Agency/Authority | Key Deliverable | Timeline/Requirement |

|---|---|---|---|

| Income Tax Registration | FBR (Federal Board of Revenue) | NTN (7-digit number) | Immediate (Required for banking) |

| Banking Activation | Commercial Bank | Corporate Bank Account | 1–2 weeks (After SECP/NTN obtained) |

| Sales Tax (STRN) | FBR | STRN | Requires NADRA biometric verification within 30 days. |

| Labor/Social Security | PESSI/SESSI/EOBI | Mandatory Enrollment | Within 30 days of reaching 5 employees. |

Special Considerations for Foreign Investment

A critical consideration for transnational businesses is whether non-nationals can register a company in Pakistan. The answer is yes, but the process introduces new layers of non-supervisory complexity and strict attestation conditions mandated under the Companies Act, 2017.

Reality Structures for Foreign Realities

Foreign investors generally register under one of the following structures:

Wholly Possessed Subsidiary

Registering an original private limited company in Pakistan where the foreign parent company owns 100% of the shares. This is the favored route for marketable operations and direct investment.

Branch Office or Liaison Office

These non-commercial (Liaison) or design-specific (Branch) services require unequivocal prior approval from the Board of Investment (BOI) before the SECP proceeds with enrollment.

Regulatory Layering and Documentation Hurdles

Foreign enrollment is subject to multi-layered scrutiny, which significantly extends the company’senrollment timeline in Pakistan compared to that of the original promoters. The process demands scrupulous adherence to transnational standards for document mediation.

Consular Attestation

Pukka clones of the foreign parent company’s indigenous documents (duty, MoA/AoA) must be apostilled or inked and latterly authenticated by the Pakistani Consulate in the country of origin.

Pre-Registration Blessings

Branch and Liaison services bear BOI authorization. Businesses in sensitive sectors (e.g., finance, energy) may bear further concurrence from the State Bank of Pakistan (SBP) or applicable Ministries.

Security Clearance

In specific cases, particularly involving citizens from security-sensitive authorities, unequivocal security concurrence may be required before objectification. Likewise, foreign directors or subscribers must gain Digital Hand Instruments (DSCs). If the foreign director cannot be physically present, the process requires inked and consular-attested Power of Attorney documents to grease the DSC process, adding logistical complexity. This strict multi-agency demand means foreign enrollment is a significant logistical design, heavily dependent on technical premonitory services to manage transnational compliance and non-supervisory synchronization.

Sustaining Your Commercial Status: The Annual Compliance Roadmap

Carrying the Certificate of Incorporation is the first step; maintaining commercial integrity requires adherence to a strict schedule of post-incorporation statutory forms. Failure to meet these deadlines can lead to penalties, forfeitures, and, eventually, executive cancellation of the registrant company’s status, marking it as being in “bad standing.”

SECP Statutory Forms

Companies must file several obligatory forms with the SECP annually or upon specific trigger events:

Periodic Return (Form A)

This document provides a summary of the company’s affairs for the time and must be filed annually, within 30 days of the Annual General Meeting (AGM). The form requires a digital hand.

Changes in Directors Officers (Form 29)

This is a critical area of compliance failure for numerous SMEs. Any change in the appointment, abdication, or particulars of the directors, CEO, or other officers must be notified via Form 29 within 15 days of the change. Executive detentions in standardizing internal changes frequently lead to non-compliance, resulting in late freight and SECP notices.

Notice of Change of Registered Office (Form 21)

Must be filed within 15 days of shifting the sanctioned company address.

Filing Financial Statements

The company’s audited fiscal statements must be filed with the SECP before holding the AGM.

FBR Duty Forms

Post-incorporation, the company is responsible for timely filing of its periodic Income Duty Returns via the FBR Iris portal and, if applicable, yearly or bi-monthly Sales Duty Returns. Harmonious and accurate compliance with duty scores is essential to avoid penalties and implicit nonsupervisory enforcement conduct. Timely conservation of these compliance scores is not a reactive task; it demands a visionary, managed strategy.

The strict 15-day deadline for filing Form 29 following changes in operation exemplifies the tight leash on commercial governance. Companies frequently fail to manage these executive tasks efficiently, resulting in habitual noncompliance and increased nonsupervisory threat exposure. Maintaining good standing through structured compliance operations supports long-term growth, enhances investor confidence, and strengthens Business Development opportunities in Pakistan’s evolving commercial ecosystem.

Case Study in Precision Accelerating Pvt Limited Company Registration for a Tech Incipiency

The theoretical approach to Pakistan company formation often reveals practical gaps when applied to critical, real-world scenarios. This imaginary case study demonstrates how expert discussion can alleviate the essential limitations in the digital process. One of our guests, Introduce Digital Results, was a three-member technology incubator that urgently needed to enroll as a private limited company to finalize a pivotal seed funding agreement. The investment was contingent upon their producing the Certificate of Incorporation within a narrow ten-day window. The guests were new to the SECP protocols, especially the mandatory requirement for Digital Subscriber Cards (DSCs) for all three subscribers.

The Challenge and The Backups

The standard objectification timeline was inadequate. Likewise, the topmost logistical threat was the time needed to secure three individual DSCs from NIFT, as this process requires individual physical verification and attestation, irrespective of the SECP’s digital speed. This DSC process, obligatory for all subscribers, introduced the primary detention factor. Also, the posterior FBR NTN enrollment and bank account opening had to be executed without detention to admit the capital.

PFOC Result and Prosecution Strategy

Concurrent Digital Preparation Feting the DSC time Gomorrah, advisers at Pakistan’s First Online Consultants (PFOC) initiated the NIFT DSC operations immediately, guiding all three subscribers through the attestation and verification process coincidently with other introductory tasks.

Strategic Filing and MoA Customization. While DSCs were being reused, the company name was reserved, and the Memorandum and Articles of Association were fleetly drafted and customized specifically to define the scope of their IT services business, precluding implicit rejections grounded on general objects.

Upon damage to the three necessary DSCs, PFOC employed the Fast Track Registration Services (FTRS) and submitted the combined objectification operation.

Rapid Activation and Capital Access. Introduce Digital Results entered its Certificate of Incorporation within three business days from the original discussion, successfully meeting the investor deadline. Following objectification, PFOC consummately navigated the Bank/NTN incongruity by coordinating with a mate bank to gain provisional account attestation, expediting the FBR NTN accession. This precise prosecution allowed the customer to open the commercial bank account immediately and admit the secured investment capital, enabling them to start a company in Pakistan effectively and subsidies it without non-supervisory detention.

This script highlights that although the technology (eZfile, FTRS) provides speed, true effectiveness in company confirmation is achieved by managing the analogue, third-party, and paradoxical dependences (DSC procurement, bank verification, NTN allocation).

How PFOC Ensures Seamless Company Confirmation

The non-supervisory terrain of company enrollment in Pakistan is characterised by reliance on end-to-end digital processing, intertwined with strict attestation conditions and an obligatory physical presence. Pakistan’s First Online Consultants (PFOC) specialises in transubstantiating this complex, non-supervisory terrain into a flawless, rapid-fire, and biddable executive process for entrepreneurs.

Strategic Planning and Structure Optimization

PFOC provides critical pre-emptive services, helping guests choose the optimal legal structure, whether a Single Member Company (SMC) for independence or a private limited company for participatory equity. This includes guiding the strategic decision regarding Authorised Share Capital to minimise original SECP fees while planning for future growth and capital increases.

End-to-End SECP Management

We handle the obligatory digital prerequisites that frequently stall the process. This includes managing the pivotal DSC operations for all original and foreign directors’ subscribers, ensuring compliance with the Companies Regulations, 2024, and executing rapid-fire, indefectible forms via eZfile and FTRS. PFOC turns the oddities of online company enrollment in Pakistan into a hassle-free executive task.

Attestation and Legal Guarantee

The expert platoon guarantees the professional drafting and submission of the Memorandum of Association (MoA) and the Articles of Association (AoA), ensuring these foundational documents are customised to the customer’s marketable intent, not simply fulfilling non-supervisory checkboxes. PFOC ensures that all KYC attestation (CNICs, challans, affidavits) complies with the most recent norms, mitigating the top threat of operational rejection.

Post-Incorporation Activation and Compliance

PFOC streamlines the activation phase by expediting FBR NTN/STRN enrollment and furnishing technical backing for commercial bank account opening. This includes navigating the physical verification and biometric requirements essential to the FBR and banking processes, and resolving the Bank/NTN incongruity to ensure immediate functional capability.

Ongoing Governance and Tax Services

Beyond objectification, PFOC offers comprehensive duty planning and governance services. This ensures timely statutory compliance, including the pivotal periodic forms (Form A, Form 29, etc.) and FBR returns, guaranteeing the company maintains “good standing” with SECP and avoids severe non-supervisory penalties. PFOC supports nonstop legal adherence throughout the company’s lifecycle through expert Legal Consultancy.

To register a business in Pakistan, you must follow four main stages: strategic planning, company enrollment with the SECP via the eZfile portal, duty enrollment with the FBR (NTN/STRN), and opening a commercial bank account, along with labour compliance. The most popular structure for starting a company in Pakistan is private limited company registration, due to its flexibility and limited liability benefits.

To start a business in Pakistan, you need to register your company with the SECP, prepare the legal documents (MoA/AoA), and obtain an NTN for duty purposes. Choosing the right structure, such as a private limited company, ensures legal recognition and smoother financial operations.

The most effective system is online company enrollment in Pakistan via SECP’s eZfile portal. The process includes stoner enrollment, carrying Digital Hand Instruments (DSCs), business name enrollment in Pakistan, and submitting all needed documents with the specified figure.

For pvt limited company enrollment in Pakistan, you need at least two directors, valid CNICs or passports, Digital Signature Certificates (DSCs), the proposed company name, a registered office address, and payment of SECP fees. These comprise the requirements and procedures for registering a company in Pakistan.

The Pakistan company formation process generally takes 3–5 business days through SECP’s eZfile system, while Fast Track Registration (FTRS) can complete it within 4 hours. A full operational setup, including tax registration and bank account opening, may take up to 15 days.

Yes, foreign investors can register a company in Pakistan, typically as a private limited company or a branch office, with approvals from the Board of Investment (BOI) and proper consular attestation of all supporting documents.

The LTD company registration fee depends on the authorised share capital. For small companies (capital up to PKR 100,000), online company registration in Pakistan costs around PKR 2,200, excluding DSC and consultancy fees.

Conclusion:

The geography of Pakistan company confirmation is defined by a delicate balance between rapid-fire digital processing and strict attestation compliance. The SECP’s eZfile system offers an unknown speed, represented by the 4-hour FTRS option, yet this speed is contingent upon the faultless execution of critical pre-filing conditions, such as the accession of DSCs and the strategic drafting of MoA/AoA.

Successfully covering the trip from conception to fully biddable private limited company enrollment requires not only knowledge of the law but also technical moxie in navigating the succession interdependencies, such as the Bank/NTN incongruity and the physical compliance traps essential to STRN biometric verification.

By understanding these complications and using technical support, promoters can mitigate the risk of rejection, ensure continuous, unsupervised adherence (through timely filings like Form 29), and secure the long-term operational integrity of their business. Partnering with expert advisers like PFOC ensures that the transition to a formal commercial structure is biddable, rapid-fire, and strategically optimised for substance and sustained Statutory Compliance.