Outsourced Accounting Services in Pakistan: Benefits, Cost, and Choosing the Right Partner

Request a Free Quote

Introduction

The way firms manage money is changing fast. Companies worldwide are moving away from large in-house finance teams. Instead, they choose to outsource accounting services to expert partners who use the latest tools. This is no longer just about saving money. It is now a core part of staying quick and legally compliant.

The global market for outsourced finance work is set to top $110 billion by 2032. For small and medium firms in Pakistan, and for global companies expanding here, this shift creates a real chance to work smarter.

What Is Driving the Global Shift in Finance?

New tools and talent gaps are changing what a CFO does every day. Many firms now build a virtual finance team instead of hiring a full in-house department. The goal is not just to find the lowest price. It is to find partners who add real value. One of the biggest shifts is the move to “Continuous Close.” This means firms track their money in real time. They no longer spend ten days at month-end on old data. They no longer wait until year-end to know if they are doing well.

Demand is rising for accountants who understand AI tools. Firms want advisors who look forward, not just backward. They want insight into the future, not just reports on the past. Teams that mix human skill with smart tools give firms a clear edge. For firms working across many countries, experts who know local tax rules add even more value.

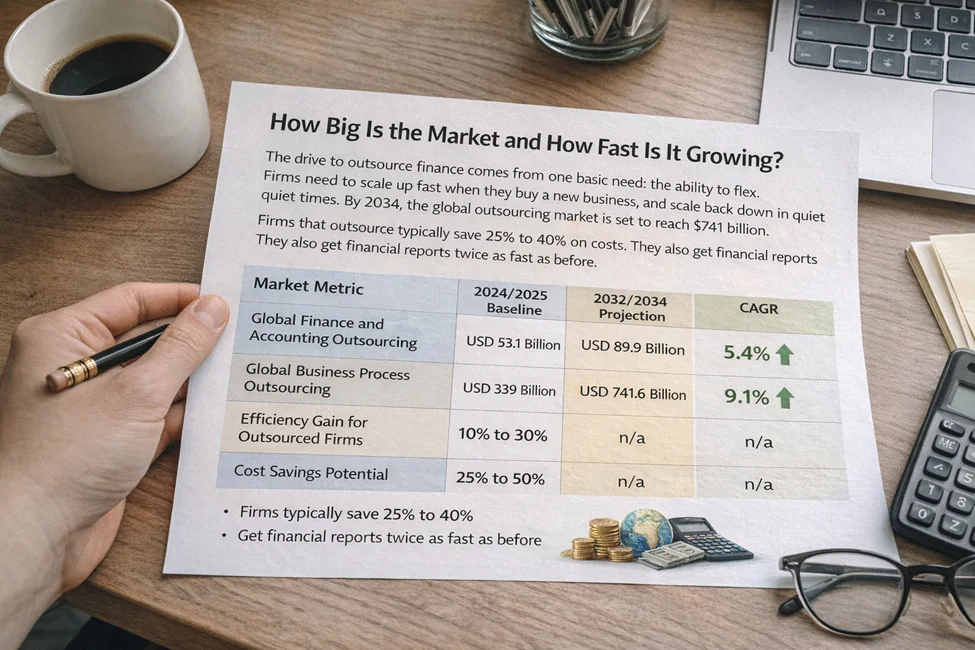

How Big Is the Market and How Fast Is It Growing?

The drive to outsource finance comes from one basic need: the ability to flex. Firms need to scale up fast when they buy a new business, and scale back down in quiet times. By 2034, the global outsourcing market is set to reach $741 billion. Firms that outsource typically save 25% to 40% on costs. They also get financial reports twice as fast as before.

| Market Metric | 2024/2025 Baseline | 2032/2034 Projection | CAGR |

|---|---|---|---|

| Global Finance and Accounting Outsourcing | USD 53.1 Billion | USD 89.9 Billion | 5.4% |

| Global Business Process Outsourcing | USD 339 Billion | USD 741.6 Billion | 9.1% |

| Efficiency Gain for Outsourced Firms | 10% to 30% | n/a | n/a |

| Cost Savings Potential | 25% to 50% | n/a | n/a |

Why Is Pakistan a Top Spot for Outsourced Accounting Services?

Pakistan has built a strong name as a top spot for outsourcing accounting services. The country has a large, trained workforce with strong English skills. Experts here work to global standards. Government spending on tech and business services between 2020 and 2025 has pushed this growth further. With over 500,000 people in tech and business services, Pakistan is a deep talent pool for tax, bookkeeping, and finance advisory work.

UK firms have found that outsourcing to Pakistan cuts costs by up to 50%. Local teams adapt fast to foreign tax rules. Heavy spending on data security keeps sensitive financial data safe. The mix of cost savings, skilled talent, and strong data security makes Pakistan one of the best outsourcing spots in the world.

Accountants in Pakistan are trained to a high standard. The reports they produce meet global quality benchmarks every time. They use modern cloud platforms that give clients a live view of their finances at any time. Pakistan’s time zone also works in the client’s favour. Finance teams here can work through tasks at night while clients in the UK or Europe are asleep. This “follow-the-sun” model means work is ready and waiting when the client starts their day.

What Does It Really Cost to Hire In-House vs. Outsource?

The true cost of a staff member is often the key deciding factor. When you hire in-house, you pay salaries, office costs, and software fees every month no matter how busy you are. Outsourcing changes this model. Your costs flex with your actual work volume. This keeps cash flow stable and easy to predict.

When you hire an in-house accountant, you pay more than their base salary. You also cover health plans, pensions, hiring fees, training, and software licences. Add it all up, and the true cost runs 30% to 50% above the base salary. With a good outsourcing partner, you get a full team of tax experts, bookkeepers, and finance advisors. This costs less than one senior in-house hire.

| Role / Expense | In-House Monthly Cost (PKR) | Outsourced Monthly Equivalent (PKR) | Savings |

|---|---|---|---|

| Junior Accountant (Entry) | 80,000 to 120,000 | Part of Managed Service | High |

| Senior Accountant / Manager | 150,000 to 300,000 | Part of Managed Service | High |

| Chartered Accountant (Expert) | 200,000 to 1,000,000 | Fractional / Advisory Rate | Significant |

| Benefits (EOBI, Health, Bonus) | 20% to 35% of Salary | Included in Fee | 100% |

| Software and IT | Variable (Direct Cost) | Included / Vendor Pricing | 40% to 60% |

Outsourced bookkeeping services also remove a key risk: staff turnover. If a team member leaves, your provider finds a new one. Your service carries on with no break in quality.

Case Study: Fixing a Cash Flow Problem for a Pakistani SME

A local retail firm in Pakistan had strong sales but kept running short of cash. The cause was simple: manual bookkeeping. Invoices went out late and the owner had no clear picture of daily cash flow. PFOC moved the firm to a cloud platform with auto bank feeds. The owners had a live finance dashboard on screen every morning. Faster invoicing and tighter spending control helped the firm grow its cash by 25% in just three months.

Testimonial;

“The way the PFOC handled our finances changed everything for us. Before, it felt like we were driving our business in the dark. Now it is like we have a clear map of our cash and profits. This gives us the confidence to make bold moves and grow faster.” A. Rehman, Operations Manager, Growing Retail Chain, Lahore

How Do Outsourced Accounting Services Handle Tax Compliance in Pakistan?

Tax compliance in Pakistan is complex. Rules change often, penalties are strict, and managing both federal and provincial duties takes constant care. Firms that use an outsourced accounting firm in Pakistan can stay ahead of every deadline. They do this without draining internal time on rule tracking.

The FBR’s IRIS 2.0 portal is the main platform for income and asset filings. It is a key part of the Digital Pakistan plan. For SMEs, staying on the FBR’s Active Taxpayer List is vital. Losing this status triggers higher withholding tax rates on bank deals, imports, and utility bills. Under the latest rules, taxpayers must also link their CNIC to their phone number and bank account.

| Compliance Requirement | Entity Applicability | Primary Deadline | Penalty for Default |

|---|---|---|---|

| Income Tax Return Filing | Individuals, AOPs, Companies | Sept 30 / Dec 31 | Fines and Higher WHT |

| Sales Tax on Services | Service-based Firms | Monthly (15th to 18th) | Surcharges and Audits |

| Withholding Tax Statements | Firms Making Payments | Monthly / Quarterly | Personal Liability |

| SECP Annual Return (Form A/B) | Registered Companies | 30 days post-AGM | Fines and Deactivation |

The SECP requires every private company to keep accurate records and file updates on time. Appointing a new director means filing Form 29. Moving to your office means filing Form 21. Many new firms miss these steps. The result is legal notices or, in serious cases, a company shutdown. An outsourced accounting team tracks these deadlines and files them in every form on time.

Service tax in Pakistan works on a provincial model. The Punjab Revenue Authority (PRA) covers Punjab, and the Sindh Revenue Board (SRB) covers Sindh. Both bodies use a “negative list” approach. This means every service is taxed by default unless listed as exempt. Standard rates are 13% in Sindh and 16% in Punjab. Some services, like telecom, can attract rates as high as 19.5%. Firms that work across provinces need expert help to avoid paying the same tax twice.

What Are the Tax Rules for E-Commerce Firms in Pakistan?

Pakistan’s online retail sector has grown fast, and the government is tightening rules to match. A 2025 update brought digital sales firmly into the tax net. Sellers, platforms, payment gateways, and courier firms each now carry specific tax duties. The burden of collection does not rest with one party alone. It spreads across the whole digital supply chain.

The government wants to shift people from cash to digital payments. To support this, different payment methods carry different tax rates. Card and bank app payments carry a standard rate. Cash on Delivery is handled at a different rate to push people toward digital habits. Online markets can no longer host sellers who are not registered. Any platform that fails to collect tax from a seller must pay a fine itself.

| E-Commerce Participant | Compliance Responsibility | Potential Penalty |

|---|---|---|

| Seller (Vendor) | Registration with FBR (Income and Sales Tax) | Up to Rs. 1M / Prosecution |

| Marketplace / Platform | Verification of Seller Registration | Rs. 500k to 1M per default |

| Courier / CoD Agent | WHT Deduction (2%) and Remittance | 100% of Tax Amount |

| Payment Gateway | WHT Deduction (1%) and Remittance | 100% of Tax Amount |

Managing thousands of small sales every day is a real accounting challenge. Tools like A2X solve this by linking directly to platforms like Amazon or Shopify. They push clean, sorted data into software like QuickBooks. Sales go in one folder, fees in another, and taxes land in the right place. Without this type of tool, tracking profit across a high-volume online store is very hard to manage.

How Does Inventory Valuation Affect Tax and Profit for Manufacturers?

For manufacturing firms, choosing the right inventory method is a big financial decision. It affects taxable profit, investor reports, and cash flow planning. In Pakistan, raw material prices like steel and fabric can rise quickly due to inflation. The method you choose has a direct financial impact. The two most common options are FIFO (First-In, First-Out) and Weighted Average Cost.

FIFO works like a queue. The first items bought are the first ones sold. This method suits firms that sell fresh goods, seasonal fashion, or fast-changing tech. During inflation, FIFO shows higher profits. This is because you sell older stock bought at lower prices. The Weighted Average Cost method blends old and new stock costs into one average figure. This smooths out price swings and suits firms that sell large volumes of the same item, like fuel, chemicals, or basic packing materials.

| Feature | FIFO (First-In, First-Out) | Weighted Average Cost (WAC) |

|---|---|---|

| Best For | Perishables, Fashion, Tech | Chemicals, Fuel, Bulk Goods |

| Financial Impact | Higher profits during inflation | Smooths out price swings |

| Balance Sheet | Reflects current market value | Reflects an average cost layer |

| Complexity | High (requires lot tracking) | Lower (continuous calculation) |

| Regulatory | Preferred under IFRS | Accepted globally (GAAP/IFRS) |

Do You Need an Outsourced CFO for Your Business in Pakistan?

A Chief Financial Officer does much more than manage compliance. They build financial strategy, spot risk, and guide the firm toward long-term growth. Most SMEs and startups cannot afford a full-time CFO. But they still need that level of thinking to compete. Outsourced CFO services in Pakistan fills this gap. They give firms access to a senior finance expert on a part-time basis. This costs far less than a full-time hire.

These experts handle a wide range of high-value tasks. For budgeting and planning, they build a financial roadmap covering both big capital costs and daily expenses. For business value and mergers, they work out what a firm is worth and run financial checks when one firm looks to buy another. For risk management, they set up internal controls to protect assets and cut the chance of fraud. For fundraising, they prepare financial models and documents to help firms approach banks or investors for growth capital.

How PFOC Can Help Your Business

At PFOC (Pakistan’s First Online Consultants), we offer a full range of outsourced accounting and finance services. We go well beyond tax filing and company registration. Here is what working with us looks like:

FBR and Tax Compliance

- Manage all FBR filings through IRIS 2.0

- Get your National Tax Number (NTN) and register you for all relevant taxes

- Handle your provincial tax registration with PRA and SRB

- Manage double-tax risks if you work across provinces

SECP and Company Reporting

- Handle all SECP filings including Form 21, Form 29, and annual returns

- Manage share ownership reports and board change notifications

- Always keep your company status active and fully compliant

Bookkeeping and Financial Reporting

- Record all transactions in real time using cloud accounting tools

- Reconcile your bank accounts every month

- Produce accurate financial statements ready for auditors or investors

- Provide a live dashboard so you always know where your money stands

CFO Advisory

- Provide budgeting, cash flow forecasts, and KPI dashboards

- Support fundraising, mergers, and business valuation work

- Design risk controls and internal audit frameworks for your firm

Data Security and SBP Compliance

When you outsource finance functions, strict rules apply around who is responsible. The State Bank of Pakistan (SBP) Risk Management Framework covers outsourcing for banks and financial firms. Core functions like internal audit must stay in-house. Non-core services like bookkeeping can be outsourced with proper oversight in place. We help you set up every agreement to meet SBP rules. We also make sure all your data is encrypted, audit-ready, and safe from cyber threats.

Conclusion

Outsourcing your finance and accounting functions is a strategic move. It shifts finance from a cost centre into a real business advantage. For firms working in or with Pakistan, the mix of top talent, low cost, and deep tax knowledge is hard to match. The compliance landscape is going digital fast, and the value of a trusted, tech-led accounting partner will only grow from here.

By adopting a flexible, outsourced finance model and working with experts like PFOC, firms can stay strong, meet every compliance duty, and build a solid base for growth in local and global markets.

FAQs:

Firms can cut costs by up to 50%. They get direct access to qualified Chartered Accountants and specialist tax experts. This lets business owners focus on growth instead of managing finance admin.

Costs depend on the complexity of the business. Basic packages for small firms run between PKR 50,000 and PKR 150,000 per month. Full-service packages with CFO oversight or complex structures can reach PKR 500,000 or more per month.

Look for a firm with experience in your field. Check their knowledge of cloud tools like QuickBooks or Xero. Ask about their data security approach, ideally SOC 2 certified. Confirm they have a strong record of meeting statutory deadlines.

They handle FBR return filing, withholding tax, and provincial sales tax with PRA and SRB. Accurate and timely filing protects firms from penalties and legal notices.

The main concerns are loss of direct control and data security. You manage these risks by choosing firms with encrypted systems, clear SLAs, and defined accountability in their contracts.

Yes. Outsource accounting for SMEs gives access to a full finance team on a flexible basis. You get top-level expertise without the cost of full-time staff.

They provide cash flow forecasts, budget models, and KPI dashboards. This gives business owners a forward-looking view of their finances, not just historical reports.

The SBP Risk Management Framework and SECP Guidelines both apply. Core functions like internal audit must stay in-house. Non-core financial services can be outsourced under proper monitoring.

Start by defining the scope of work. Then review providers and move your data to a cloud platform. Set up a regular reporting schedule. A good provider will guide you through each step.

Look for firms with tiered pricing. This lets you start with essential bookkeeping services and add layers like tax planning or CFO support as your business grows.

Outsourced bookkeeping services use digital tools to record transactions, reconcile bank accounts each month, and keep financial statements accurate at all times.

Firms save 30% to 50% by cutting full-time salaries, EOBI and PESSI costs, office space, and software licenses. The total saving goes well beyond just the salary figure.