Tax Compliance & Filing Guide for Businesses and Individuals in Pakistan

Request a Free Quote

Introduction

The landscape of tax filing in Pakistan has evolved rapidly. With the Federal Board of Revenue (FBR) focusing on a documented economy, compliance is now not only enforceable but also makes business sense. Are you a salaried employee, a freelance writer who earns 600,000 (6 Lakh), or an SME owner? Knowing how to file tax returns with FBR will help you avoid penalties and protect your financial interests.

In this comprehensive guide, you will learn everything from income tax registration to complex wealth reconciliation. We cover the specific steps of online income tax return filing in Pakistan, best practices for managing tax documentation, and the critical deadlines that determine your status on the Active Taxpayers List (ATL). If you want a dedicated walkthrough, refer to PFOC’s step-by-step income tax return filing guide.

By the end of this article, you will have a clear roadmap for achieving full tax compliance and leveraging the benefits of being a filer in Pakistan. If you want professional handling end-to-end, start with PFOC statutory compliance support.

Tax Filing Basics in Pakistan

What does “tax filing” mean in Pakistan?

In simple terms, tax filing in Pakistan is the process of submitting a formal declaration of your annual income, expenses, taxes paid, and assets to the FBR. This is done via the IRIS portal, an online platform designed for online tax filing. If you prefer a practical filing flow, use this income tax return filing walkthrough as your reference checklist.

Tax year vs calendar year

Unlike Calendar Year (January to December), the Tax Year starts from July 1 and ends on June 30 in Pakistan. For instance, Tax Year 2025 runs from July 1, 2024, through June 30, 2025.

NTN vs CNIC registration

For individuals, your 13-digit CNIC acts as your National Tax Number (NTN). However, for income tax registration, you must still “activate” your CNIC in the FBR system to generate a password for the IRIS portal. For companies and AOPs (partnerships), a unique 7-digit NTN is issued. If you’re setting up a business entity alongside tax onboarding, see company registration in Pakistan (expert guide).

Filer vs non-filer

- Filer: A person whose name appears on the Active Taxpayers List (ATL). They enjoy lower withholding tax rates on banking transactions, property transfers, and vehicle purchases.

- Non-filer: A person who has not filed their return or missed the deadline. They face significantly higher tax rates and potential scrutiny from the FBR.

ATL (Active Taxpayers List): what it is and why it matters

The ATL is a real-time list of individuals and businesses who have complied with tax filing in Pakistan. Being on this list is the primary goal of tax return filing for individuals, as it serves as proof of compliance for banks and other institutions.

Do You Need to File?

Eligibility decision guide (individuals)

You are generally required to file if your annual income exceeds PKR 600,000, you own a vehicle above 1000cc, or you own immovable property with a land area of 500 square yards or more in specified urban areas.

Salaried: employer deducted tax, do you still file?

Yes. A common myth is that if your employer deducts taxes, you don’t need to file. This is incorrect; you must file to declare your wealth and reconcile the tax already paid.

Unemployed/students: when filing still applies

If you are a student or unemployed but own assets (like a car or property gifted by parents), you should still consider tax return filing for individuals to maintain “Filer” status and avoid high withholding taxes on those assets.

Overseas Pakistanis/non-residents: When filing applies

Non-residents only pay tax on Pakistan-sourced income. However, if you maintain high-value bank accounts or own property in Pakistan, tax filing in Pakistan is necessary to justify the source of funds.

Freelancers: when remittances still require filing

Even if your foreign remittances are tax-exempt or taxed at a reduced rate, you must file a return to claim that exemption. Without tax compliance for freelancers, the FBR may treat those inflows as unexplained income.

Businesses: when “nil/low activity” still requires compliance

If a company or AOP is registered, it must file a return even if there is zero turnover. This is a core part of ongoing compliance and helps avoid penalties. For businesses that want structured governance beyond annual filing, use PFOC statutory compliance services.

Registration and Setup (IRIS + NTN)

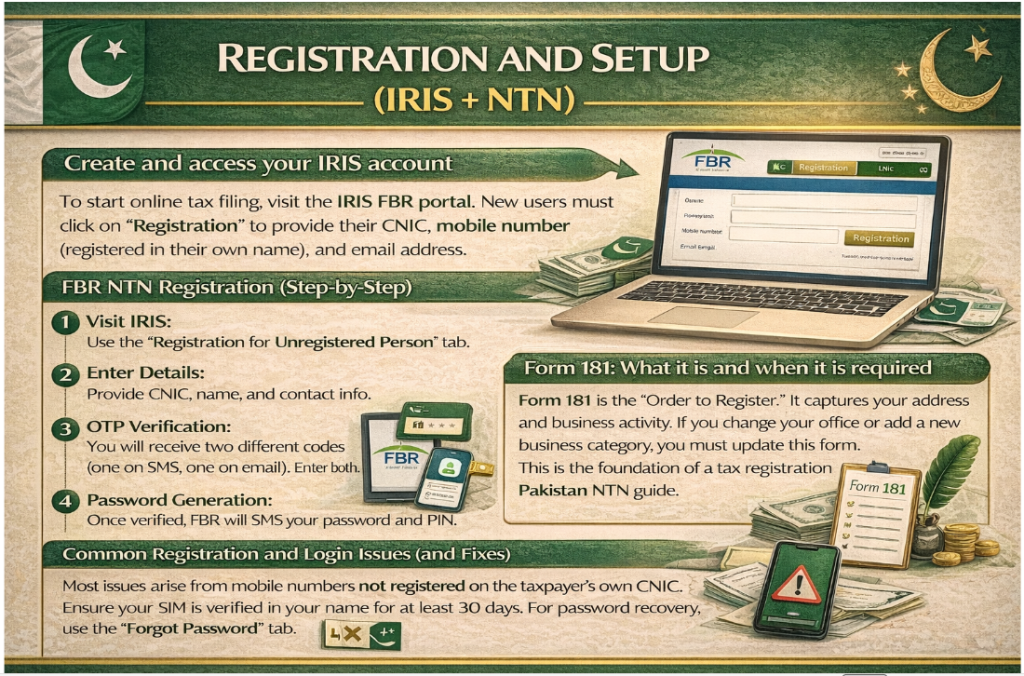

Create and access your IRIS account.

To start online tax filing, visit the IRIS FBR portal. New users must click on “Registration” to provide their CNIC, mobile number (registered in their own name), and email address.

FBR NTN registration (step-by-step)

- Visit IRIS: Use the ‘Registration for Unregistered Person’ tab.

- Enter Details: Provide CNIC, name, and contact info.

- OTP Verification: You will receive two different codes (one via SMS, one via email). Enter both.

- Password Generation: Once verified, FBR will SMS your password and PIN.

Form 181: what it is and when it is required

Form 181 is the “Order to register.” It captures your address and business activity. If you change your office or add a new business category, you must update this form. This is the foundation of a tax registration Pakistan NTN guide.

Standard registration and login issues (and fixes)

Most issues arise from mobile numbers not registered on the taxpayer’s own CNIC. Ensure your SIM is verified in your name for at least 30 days. For password recovery, use the “Forgot Password” tab.

Documents You Need Before Filing

Individual/Salaried Checklist

- Annual Salary Certificate (Form 149) from employer.

- Bank statements (July 1 to June 30).

- Certificates of tax deduction on PTCL, Mobile, or Electricity bills.

- Personal expense records (utilities, school fees, travel).

Freelancer/Professional Checklist

- Foreign remittance certificates (encashment certificates) from the bank.

- Invoices are issued to foreign clients.

- Proof of business expenses (software subscriptions, internet, co-working space).

Business Checklist (tax documentation for Pakistan companies)

- Profit and Loss Statement and Balance Sheet.

- Details of creditors and debtors.

- Depreciation schedules for fixed assets.

- Proof of withholding tax deposits (Challans).

Recordkeeping standards (minimum best practice)

Businesses must maintain accounts for at least six years. For individuals, keeping digital folders of bank statements and tax certificates is the best way to ensure tax audit preparation and Pakistan business readiness.

How to File an Income Tax Return in IRIS (Step-by-Step)

Filing flow overview

The FBR tax filing in Pakistan generally follows a flow of:

→ Login

→ Declaration

→ Income Entry

→ Tax Credit/Adjustment

→ Wealth Statement

→ Verification

→ Submission.

Individuals: salaried return (what to enter and where)

Open Form 114(2) and enter your gross salary under the “Salary” head. Any tax deducted by your employer should be entered in the “Adjustable Tax” tab under the relevant section code.

Individuals: other income types

Income from property (rent), bank profit (profit on debt), and capital gains from shares must be entered in their respective tabs. IRIS automatically calculates the tax based on the current year’s rates.

Freelancers/professionals: declaring income and receipts

Freelance income should be declared under the “Business” head .If you are receiving foreign remittances for IT services, you may qualify for a reduced tax rate (currently 0.25%), provided you are registered with the Pakistan Software Export Board (PSEB)., provided you have the bank’s encashment certificates.

Businesses: basic filing workflow for SMEs

SMEs must provide a summary of revenue and expenses. Ensure your “Net Profit” in the business tab matches the increase in your business capital in the wealth statement to avoid reconciliation errors. For businesses needing broader tax structure planning, align filing with PFOC tax planning support.

Wealth Statement (The Thing Most People Get Wrong)

What a wealth statement is

A wealth statement is a declaration of everything you own (assets) and everything you owe (liabilities). It is mandatory for all resident individuals filing tax filing in Pakistan.

Wealth reconciliation method (simple formula)

The formula used by the FBR is:

[Opening Net Wealth] + [Inflows/Income] – [Outflows/Expenses] = [Closing Net Wealth]

Source of funds: how to explain deposits

Every asset purchase or bank deposit must have a source. If you buy a car, the money must come from either your declared income, a gift (documented with a deed), or a loan.

Practical example: income vs expenses vs asset changes

If your opening wealth was 1,000,000 PKR and you’ve made 1,200,000 PKR but spent 400,000 on living expenses, your finishing wealth should be 1,800,000 PKR. If your actual assets total 2,000,000 PKR, then 200,000 PKR will remain as an “Unreconciled Amount.

Case Study: The Reconciliation Trap

A client, Mr Kamran, had a bank balance of PKR 5 million but only declared PKR 2 million in income over three years. During his tax return filing for individuals, he failed to account for a PKR 3 million inheritance. PFOC helped him document the inheritance via a legal heirship certificate and bank transfer records. This corrected his wealth statement, bringing the unreconciled amount to zero and preventing a future audit.

Client Quote:

“PFOC’s attention to detail saved me from a massive FBR notice. They found the discrepancy I had missed for years.”

— Kamran A., Small Business Owner.

After Filing: Verification and ATL Status

What happens after you submit

Once submitted, you will receive a Computerized Payment Receipt (CPR) if you have a tax liability. Your return status in IRIS will change to “Completed.”

How to check the ATL status

To verify your status, SMS “ATL [Space] 13-digit CNIC” to 9966 or check the “Active Taxpayers List” on the FBR website.

Why ATL may not update

If you file after the tax filing deadlines, your name will not appear on the ATL until you pay a surcharge (PKR 1,000 for individuals, PKR 10,000 for companies) via a separate challan.

Deadlines, Late Filing, and Penalties

Tax filing deadlines

- Individuals/Freelancers/AOPs: The official deadline is September 30th. For Tax Year 2024, the FBR extended the deadline to October 31, 2024. For Tax Year 2025, the official deadline remains September 30, 2025, unless a future extension is granted.

- Companies: Often December 31 for corporations with a financial year ending June 30. For corporate filing context and rates, see corporate tax in Pakistan: rates and filing tips.

Late filing consequences

Late filing leads to tax penalties starting at PKR 1,000 for each day of default, subject to a minimum penalty of PKR 10,000 for individuals. More importantly, you remain a “non-Filer” until the surcharge is paid.

Back taxes: how to deal with missed years

If you have missed multiple years, do not file them all at once without professional advice. A tax filing consultant can help you create a “Wealth Reconciliation” that explains your asset growth over the missing period.

Business Compliance Map (Beyond Annual Filing)

Income tax vs withholding tax vs sales tax

Income tax is on your profit. Withholding tax is what you deduct when paying others (salaries, vendors). Sales tax is collected from customers and paid to the government through periodic returns. Stylistics. Ensure that the hyperlink is active, as this sentence is currently just a text-based cross-reference.

Tax audit preparation checklist for businesses

- Reconcile bank statements with declared turnover.

- Ensure all withholding tax bills are uploaded to IRIS.

- Maintain a physical file of all purchase and sale invoices.

- Keep salary sheets signed by employees.

Case Study: Audit Readiness

A retail company was selected for a desk audit. They lacked the organised tax documentation that Pakistani companies are required to keep. PFOC stepped in to digitise their last three years of invoices and reconciled their sales tax returns with their annual income tax filing. We represented them before the FBR, and the audit was closed with zero tax demand.

Client Quote:

“PFOC transformed our messy paperwork into an audit-proof system. Their representation gave us the peace of mind we needed.”

— Faisal M., Operations Director.

Misconceptions and Myths (Myth vs Fact)

| Myth | Fact |

|---|---|

| Employer deducted tax so I don’t need to file | False. Filing is mandatory to declare assets and remain an active taxpayer. |

| NTN means I’m automatically a filer | False. NTN is only registration; filing is a separate annual process. |

| No income means no filing | False. If you have an NTN or high-value assets, a Nil return is required. |

| Remittance income means no filing | False. You must file to legally claim exemption on foreign income. |

How PFOC Can Help (Tax Compliance Services in Pakistan)

At PFOC, we specialise in taking the stress out of the FBR tax filing process. Our team acts as a bridge between your financial data and the complex requirements of the IRIS portal.

We provide structured support for startups, SMEs, and individuals to ensure every rupee of tax paid is correctly credited, and every asset movement is defensible. For businesses that want consistent year-round control (not just annual filing), use PFOC statutory compliance services. For optimisation-focused planning that reduces avoidable exposure, see PFOC tax planning services.

Whether you need an FBR NTN registration or a comprehensive strategy for tax audit preparation for a Pakistan business, our experts are here to guide you.

Conclusion

Achieving status as an active taxpayer is more than just a legal requirement; it is a strategic advantage that lowers your cost of doing business and enhances your financial credibility. For individuals, success lies in accurate wealth reconciliation and timely filing before the October 31 deadline (for the current year).

For businesses, compliance is an ongoing journey that requires monthly attention to withholding taxes and sales tax returns. It protects the future of your finances by keeping you on top of your taxes ahead of time and providing a fair reflection of how much tax is due.

Ready to streamline your compliance? Reach out via PFOC contact and speak with a consultant.

FAQs

For people and small businesses (AOPs), that deadline is typically September 30. That said, the FBR has decided to extend the due date for Tax Year 2024 to October 31, 2024. Companies with financial years ending in June have a little more time to breathe; their returns are usually due on December 31st.

The trick is to treat tax as a monthly task rather than a yearly headache. You should file your sales tax returns every month and your withholding statements twice a year without fail. Keeping a neat paper trail where an invoice backs every bank deposit will make your life much easier if the FBR ever comes knocking for an inspection.

Everything happens on the FBR’s IRIS portal now. You sign up using your CNIC and a mobile number registered in your name, then verify your identity with the codes they send to your phone and email. Once you’re in, you fill out Form 181 with your basic business or home details to get your NTN and start filing.

Preparing for an audit is all about matching your numbers. You need to make sure the figures in your tax returns perfectly align with your actual bank statements and audited financial reports. The FBR checks explicitly if you’ve been deducting tax from your payments to vendors and employees, and if that money was actually paid into the government’s account.

If you miss the deadline, you are liable for a penalty of PKR 1,000 for each day of default, with a minimum penalty of PKR 10,000.But the real problem is losing your “Active” status on the ATL. Being a non-filer means you’ll be hit with much higher tax rates on basic things like withdrawing cash, buying a car, or transferring property.

Freelancers should use the “Business” tab in IRIS and make sure they have “encashment certificates” from their bank for every dollar they’ve earned. These certificates are your only proof to claim the special 0.25% or 1% tax rate for IT services; without them, the FBR might try to tax you at much higher standard rates.

You should keep a “Tax Folder” that holds your monthly bank statements, all buy-and-sell invoices, utility bills, and any certificates showing tax was taken out of your payments. Having these ready throughout the year means you won’t have to scramble when it’s time to file, and you’ll be ready for any surprise audit.

Think of them as two separate tracks that run together. Income tax is a once-a-year job, but Sales Tax (STRN) requires a return every single month by the 15th (for the return/Annex-C) and the 18th (for final submission). The FBR often compares the two, so the total sales you report every month must add up to the revenue you claim on your final yearly income tax return.

The biggest trap is the “Unreconciled Amount” in the wealth statement. This happens when the math between what you earned, what you spent, and what you now own doesn’t balance out. People also frequently miss out on claiming tax they’ve already paid on their mobile loads, internet bills, or vehicle registration fees.

You can easily track your history by looking at the “Completed Tasks” section in your IRIS account. To see how you appear to the public or the bank, you can use the FBR’s “Active Taxpayer List” (ATL) search tool to make sure you’re still listed as a compliant filer.

If you find a mistake after filing, you have 60 days to file a “Revised Return” through the portal without needing any special permission, if you aren’t trying to pay less tax. If it’s been more than 60 days, you’ll have to file a request with the Commissioner to explain why you need to change your records.

Don’t just pick up the cheapest person; look for someone who actually knows your industry, like how freelancer exemptions or complex corporate taxes work. A good consultant should do more than type in your numbers; they should double-check your math to catch errors before the FBR does.

You can verify them by checking if they or their firm are on the Active Taxpayers List themselves. Reputable firms like PFOC are always open about their team and will give you official FBR receipts for every task they perform, so you know your tax record is being handled properly.