Freelancer & Startup Business Registration in Pakistan: SECP, FBR, and NTN Explained

Request a Free Quote

Introduction

Thousands of Pakistani professionals today are monetizing their skills online with platforms like Upwork and Fiverr, leading to a booming freelance economy in Pakistan. Alongside this booming freelance economy, the startup ecosystem, led by fintech, SaaS, and e-commerce businesses, is also gaining momentum. However, many individuals who are part of the freelance and startup economy are still unaware of the long-term benefits of formally registering their businesses.

Formal registration provides a foundation for these businesses for long-term success, by giving them access to tax benefits and banking services, which in turn builds client trust and helps them expand their business. This guide provides a detailed overview of how to register your business in Pakistan, specifically through SECP, FBR, and provincial portals, and what benefits you can attain. So, whether you’re a content creator, a graphic designer, or a tech startup with VC ambitions, this guide will help you navigate the regulatory landscape with confidence.

Why Registering Your Business in Pakistan Matters

As more regulations come into effect and more competition enters the market, business registration is not just a legal requirement, but a strategic decision. By not registering, you lose valuable benefits such as access to funds, protection against the law, and gaining customers’ confidence. Whether you’re a startup, small business owner, or freelancer, registering shows you’re serious about your work and committed to the long term. It also provides you with the ability to open business bank accounts, compete on bids to win tenders, and avoid falling foul of taxation. Here’s just why that first formal step is so crucial.

Legal Protection

A registered business operates under Pakistani law, protecting you from liability in case of disputes, fraud claims, or client non-payment. It also secures your brand identity and legal standing.

Credibility and Market Access

Most international clients and institutions require documentation like an NTN or certificate of incorporation. Registration enhances credibility and allows onboarding onto global marketplaces, payment gateways, and enterprise projects.

Access Banks and FinTechs

Finance banks and fintechs often require registered status for opening business accounts, applying for loans, or using digital wallets. A registered business can also attract angel investors and venture capital.

Tax Compliance and Government Incentives

SECP and FBR registration lets you file returns, deduct expenses, and apply for government incentives. Pakistan’s startup policy, for instance, offers tax planning, tax breaks, grants, and exemptions to SECP-registered entities.

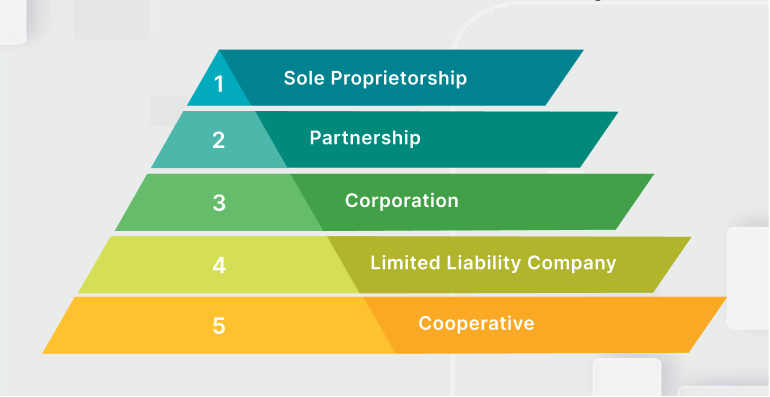

Choosing the Right Legal Structure

Choosing the right legal structure is one of the most important steps in registering a business. The legal structure of your business shapes how your business will be taxed, how much control you’ll have over your business, how you can raise funds and investments, and your exit strategy in the future. Choosing a legal structure is not just a requirement, but also a foundation for growth and success. No matter what kind of business you run, from freelancing to tech startups, if you plan to grow, you should choose the right legal structure. Here are the main options to consider.

Sole Proprietorship

A sole proprietorship is the ideal option for freelancers and small businesses operating alone, as it is quick and easy to set up, has zero incorporation fee, and offers full control. However, it does have its limitations. Sole proprietorships lack legal separation between personal and business liabilities.

Partnerships and Limited Liability Partnerships (LLPs)

This option is ideal for small teams launching a service-based business or a consulting firm, as it is registered under SECP and combines the flexibility of partnerships with limited liability protection.

Private Limited Company (Pvt Ltd)

This option is ideal for businesses and startups planning to expand, hire new employees, or raise capital, as it offers legal protection to shareholders, separates personal assets from business liabilities, and is governed by the Companies Act, 2017.

SECP registration is required, along with regular compliance, audit, and disclosure requirements.

Step-by-Step Process for SECP Registration (Pvt Ltd or LLP)

1. Create an Account on SECP eServices

Visit https://eservices.secp.gov.pk and sign up using your CNIC.

2. Reserve Your Business Name

Use the “Company Name Reservation” module. SECP will confirm availability, usually within 1–2 business days. You have 60 days to use the approved name.

3. Prepare Incorporation Documents

These include:

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- CNIC copies of directors

- Proof of address

Free templates are available for commonly structured private limited companies.

4. Obtain Digital Signatures from NIFT

Apply through the NIFT website. You’ll need scanned CNICs, passport-size photos, and an email ID.

5. Submit Online Application

Log in to SECP eServices, upload all documents, sign them digitally, and pay the fee (based on authorized capital).

6. Receive Certificate of Incorporation

Once approved, your certificate will be sent via email. You can now proceed with FBR registration and open a business account.

FBR Registration

All new businesses in Pakistan must register with the Federal Board of Revenue. During the registration process, a business will need to obtain a National Tax Number (NTN), which will be used to file taxes, open a bank account for the business, and operate legally. Without an NTN, issuing invoices and claiming tax deductions will be impossible. This registration is a mandatory step if you want to work with high-profile clients who require tax documentation.

1. Sign Up on the FBR Iris Portal

Go to https://iris.fbr.gov.pk and create an account using your CNIC.

2. Complete Your Profile

Enter details like:

- Business activity

- Trade name

- Address

- Contact details

Freelancers should select appropriate activity codes (e.g., 98154 for software development).

3. Upload Documents

Attach scanned CNIC, utility bill, and photo. A tenancy agreement may be required for rented addresses.

4. Submit Application

After submission, you’ll receive your NTN online within 1–3 working days.

Freelancers can use their home address and register as sole proprietors. No stamp paper or affidavit is required.

Provincial Registration Requirements

Registering your business doesn’t end with SECP and FBR. You also need to register with provincial or local authorities. This registration also depends on the type of business you operate. This provincial and local registration includes getting licenses, trade registrations, or professional tax certificates from the relevant departments. For example, if you’re operating in Punjab, you may need to register with the Punjab Revenue Authority. Similar rules apply in all other provinces in Pakistan. These provincial and local registrations allow you to legally provide services, collect sales tax, and follow regional regulations. Skipping this step may lead to fines or restrictions on your business.

Punjab

- Register with Punjab Revenue Authority (PRA) for sales tax on services.

- Apply for a trade license from the local municipal authority.

- Use PITB’s Business Registration Portal to link with labor, social security, and excise departments.

Sindh

- Register with the Sindh Revenue Board (SRB).

- Karachi businesses may need KMC and Sindh Excise licenses.

Khyber Pakhtunkhwa and Balochistan

- Register with respective provincial revenue authorities.

- Local Chamber of Commerce affiliation may be optional but helpful for credibility.

Using Online Portals for Fast Registration

The Government of Pakistan has improved ease of doing business through online platforms:

- SECP eServices Portal: https://eservices.secp.gov.pk

- FBR Iris Portal: https://iris.fbr.gov.pk

- Pakistan Business Portal (PBP): Unified platform for FBR, SECP, EOBI, etc.

- PRA/SRB e-Registration: Provincial tax compliance for service providers

Digital registration reduces paperwork, processing time, and the need for in-person visits.

Documentation Required for Registration

Sole Proprietorship

- CNIC (front and back)

- Mobile number and email (needed for OTP verification)

- Proof of address (can provide utility bill or tenancy agreement)

- Business description and activity code

Private Limited Company

- MOA and AOA

- Digital signatures from NIFT

- CNICs and photos of all directors

- Company address (rented or owned)

- Paid incorporation fee receipt

Additional Requirements

- PRA/SRB registration certificate (for service providers)

- Trade license (for physical shops)

- Taxpayer Profile Update Form (FBR)

Post-Registration Compliance and Tax Filing

Once registered, businesses must meet the following obligations:

Income Tax Returns

All businesses need to file annual returns via FBR’s IRIS system (link above), even when there is no income for that tax year. Freelancers who earn over PKR 600,000 per year must file personal income tax.

Sales Tax on Services

If registered with PRA or SRB, monthly returns must be submitted. The general sales tax rate is 16% on taxable services.

Withholding Tax (WHT)

If you hire freelancers, employees, or vendors, you may need to deduct and deposit WHT to FBR.

SECP Compliance

Pvt Ltd companies must submit:

- Annual returns

- Audited financial statements (if applicable)

- Directors’ reports and board resolutions

If you fail to comply with the filing deadline, you may be subject to penalties ranging from PKR 5,000 to PKR 50,000.

Cost Breakdown

Activity | Estimated Cost (PKR) |

FBR NTN (Sole Prop) | Free |

SECP Name Reservation | 200–1,000 |

SECP Incorporation Fee | 1,500–7,500 |

Digital Signature (NIFT) | ~2,000 |

PRA/SRB Registration | Free |

Trade License (Municipal) | Varies (1,000–10,000) |

Legal Consultancy (optional) | 10,000–30,000 |

Best Practices for Freelancers and Startups

- Register early to establish professional credibility and financial identity.

- Register as a sole proprietor if you’re unsure about expanding your business.

- Use official activity codes to ensure tax clarity.

- Always keep a record of invoices, receipts for business transactions, and client contracts to avoid fraud.

- File returns on time and budget for quarterly advance tax payments.

- Upgrade to Pvt Ltd when scaling, hiring, or seeking investment.

FAQS

Use the FBR IRIS portal to get your NTN as a sole proprietor. It takes 1–2 working days if documents are in order.

Yes. SECP and FBR portals allow registration from abroad using CNIC and email verification. For overseas Pakistanis, digital signatures can be arranged via the embassy or NIFT online.

While not mandatory, it is strongly recommended for separating personal and business finances. Most banks require NTN and business proof.

Freelancers have to pay income tax on net annual income above PKR 600,000. If freelancers provide services classified as taxable by their provincial authority, they are required to pay sales tax accordingly.

Conclusion

Pakistan’s ever-evolving freelance and startup economy is full of opportunities, but long-term growth and sustainability will always depend on formalization. Thanks to Pakistan’s digital portals and simplified requirements, achieving long-term growth is no longer a daunting process, as you can register your business online in under a week.